www tax ny gov online star program

If you are using a screen reading program. STAR lowers property taxes for eligible homeowners who live in New York State school districts.

Kuwait Fm Receives Malian Counterpart In New York In 2021 Malian New York Kuwait

We changed the login link for Online Services.

. Basic STAR is for homeowners whose total household income is 500000 or less. Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. The following security code is necessary to prevent unauthorized use of this web site.

Homeowners not currently receiving STAR who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance. New star recipients will receive a check directly from new york state instead of receiving a school property tax exemption. Enter the security code displayed below and then select Continue.

Edward A Rath County Office Building. The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older. STAR is New York States School Tax Relief Program that provides tax exemptions to.

The amount of the benefit will be the same. The benefit is estimated to be a 293 tax reduction. This application is for owners who had a STAR exemption on the same property in the 20152016 tax year and wish to apply for Enhanced STAR.

Erie County Real Property Tax Services. New changes to star program. Parts to the STAR property tax exemption Enhanced STAR and Basic STAR.

Buffalo New York 14202. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with.

All New Yorkers who own or have life use and live in their. STAR Check Delivery Schedule. If you are using a screen reading program.

Home are eligible for the STAR exemption on their primary residence. Visit wwwtaxnygovonline and select Log in to access your account. 95 Franklin Street - Room 100.

The following security code is necessary to prevent unauthorized use of this web site. The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners. The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes.

As a result of recent law changes the star program is being restructured. We recommend you replace any bookmarks to this. Enter the security code displayed below and then select Continue.

The School Tax Relief Star Program Faq Ny State Senate

New York Drivers License Template Psd 2020 Drivers License Alcohol Awareness Id Card Template

Online Services For Business From The Nys Department Of Taxation And Finance Finance Wine Discount Business Structure

Federal Resume Template Usajobs Pin Oleh Latestresume Di Latest Resume Job Resume Federal Resume Job Resume Examples Cover Letter For Resume

8 Image Gmc Kathua Recruitment 2020 Gmc Medical College Recruitment

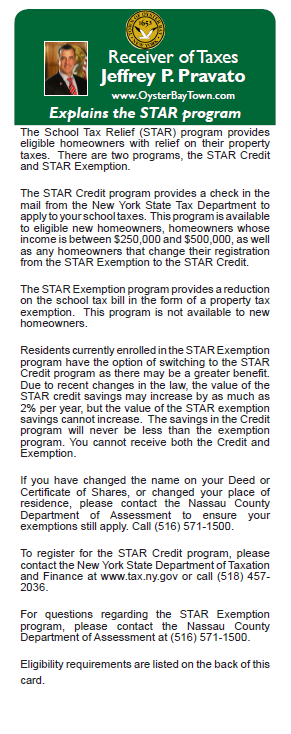

Receiver Of Taxes Town Of Oyster Bay

Smart Chart Six Ways To Tackle Sky High Inequality Billmoyers Com Economy Infographic Social Studies Worksheets Inequality

Msme Registration Process In India Small And Medium Enterprises Registration Goods And Service Tax

Our In House Ca Assisted Itr Filing Ensures That Every Return Is Filed With Accuracy Completeness Tax Advisor Tax Consulting Tax Time

Enhanced Star Income Verification Program Ivp Enhancement Stars Income

How To File Taxes Online In 2022 Cbs News

Tax Exemptions Town Of Oyster Bay

Launch Of India S First And Only Income Tax Case Research Tool Having Free Subscription Giving Access To A Repos Government Website Web Research Corporate Law

I M Reading Judge Keefe Retirement Letter On Scribd Judge Retirement Lettering

Did Onondaga County Residents Win Or Lose In First Year Of U S Income Tax Reform First Stats Are In Income Tax Onondaga County Win Or Lose